Zero to Trading in minutes: How Dhan transformed Investment Account opening

About Dhan

Founded by Pravin Jadhav, Dhan is a leading trading platform in India, consistently ranked among the top 10 stockbroking apps with 7,40,000 active traders. Known for its innovation and user-first approach, Dhan offers features like zero brokerage on delivery trades, instant payouts, and advanced trading tools.

Company highlights—

600%

year-on-year revenue

growth in FY24

₹380 crores

gross revenues

₹186 crores

in funding from BEENEXT, Mirae Asset, 3one4 Capital, Rocketship.vc

How Dhan Stands Out

When Dhan entered the market, it set out to redefine trading with innovation that hadn’t been seen in years, leading with—

Instant onboarding

Dhan brought new traders onto the platform faster than nearly any other broker, with 90% of orders processed within 15 milliseconds.

User-friendly access

Dhan replaced confusing UCC codes with login via phone number and password.

Instant transactions

Payouts were now processed in under 15 minutes so users could access their money as and when needed.

New-to-market tools

Dhan introduced trading views, charting, and advanced order types like bracket orders.

Challenges

But like every fintech disruptor, Dhan had challenges to solve.

Account verification—speed and accuracy

Traditional ways to verify a bank account—manual entries or penny-drop verifications—weren’t just slow; they were error-prone. These methods required users to remember and enter bank details or took hours or days to complete. For eager traders, errors or delays meant missed opportunity.

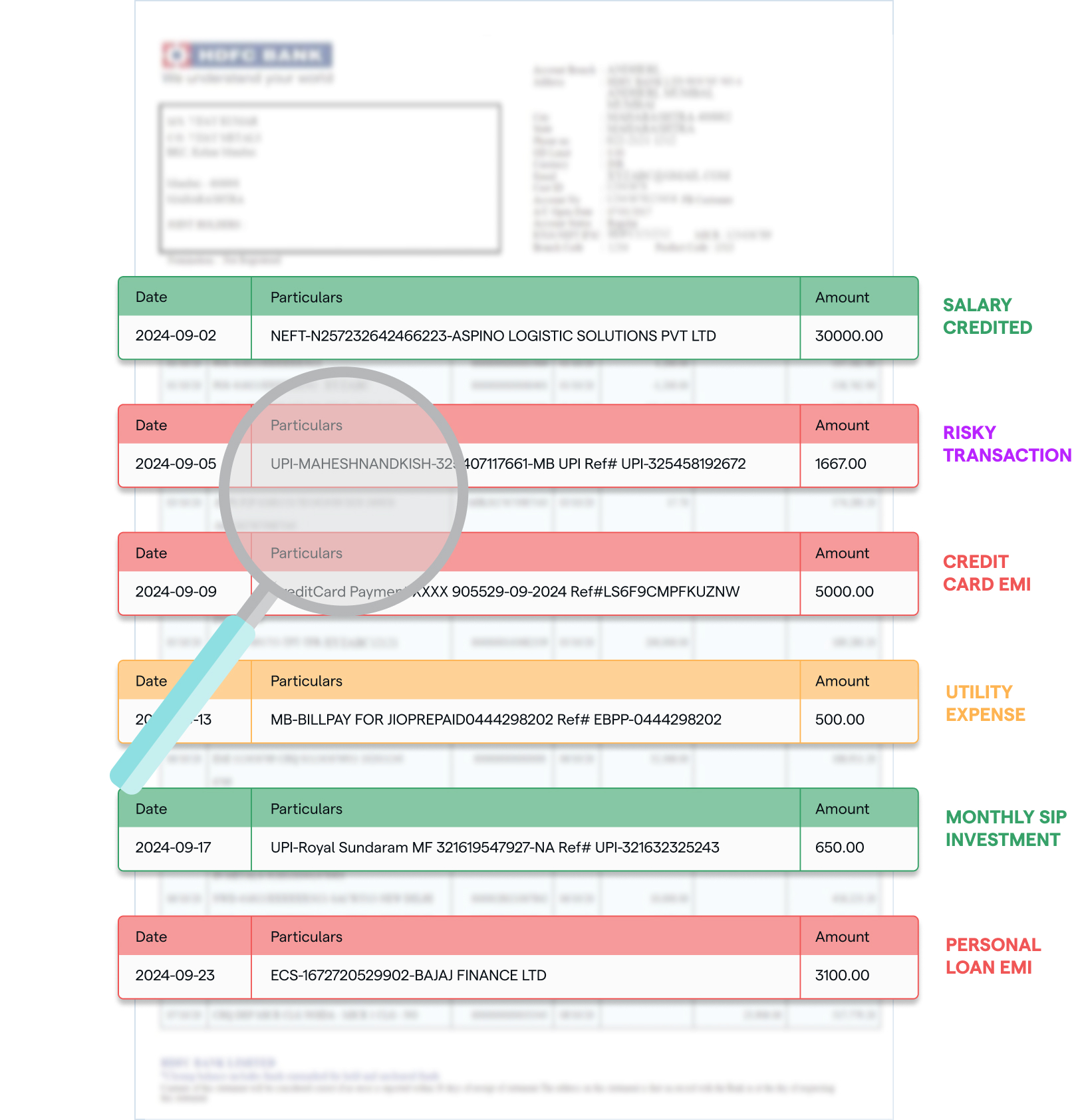

F&O trading compliance—manual and costly

F&O (Futures & Options) trading requires users to provide bank statements as income proof. Traditionally, users uploaded PDFs or screenshots, which Dhan then verified manually—each taking 2-3 minutes. Multiply that by thousands, and it’s a heavy and unscalable operational load, with users waiting anywhere from 2 to 24 hours to trade.

The Solution

Switching to Setu’s Reverse Penny Drop (RPD), PennyLess, and Account Aggregator (AA) didn’t just bring speed; it transformed Dhan’s entire onboarding and verification process.

We spoke with Anirudha, Senior Product Manager at Dhan to shed light on the evolution of Dhan's onboarding journey—

IN FOCUS

India’s first gateway for Account Aggregator—

Setu Account Aggregator gateway

Access financial data with user consent

Faster account verification with RPD and PennyLess

With RPD, Dhan made account verification faster and simpler. Users no longer had to enter long account numbers or IFSC codes.

“With traditional verification, errors in manual entry or delays with penny-drop made for frustrating user experiences. RPD simplified everything; it was instant and removed any need for users to dig out documents.”

80% of Dhan’s users organically opted for RPD or Pennyless Verification. This shift eliminated costs and sped-up the onboarding experience.

Seamless F&O verification with AA

Using Setu’s AA, Dhan automated the bank statement process for F&O compliance. Users authorise Dhan via a two-step process for income verification without manual effort.

“Verifying bank statements used to take 2,000 minutes for 1,000 users. Now, we’re done in seconds, with accuracy that no human check could match.”

Making the case internally

The cost difference was undeniable: PDF-parsing or manual verification cost upwards of ₹20 per user. Setu AA’s integration brought it below ₹5.

“AA didn’t just save us money—it allowed us to scale, to verify faster, and to meet the user experience our traders expect. It’s a win in every way.”

Impact

User experience

Instantly onboarding (even for F&O) reinforced Dhan’s user-first promise.

Automation

50% of their onboarding process automated with Account Aggregator.

Speed

F&O verification time dropped from 2-24 hours to seconds, giving traders instant access.

Savings

Cost for verification dropped by 75%, from ₹20+ to ₹5, per verification.

Dhan plans to deepen its integration with Setu to continue refining user experience. Dhan sees potential in using real-time Setu AA data to personalise trading, simplify compliance, and automate operations.

Explore other Setu products

Partner with Setu on other products that can serve use cases for lenders