Setu Account Aggregator gateway

India’s first gateway for Account Aggregator

Get financial info with consent. Verify income, monitor credit, and personal finances in one go. Replace broken methods, like screen scraping or file uploads for easier sign-ups and fewer drop-offs.

Easy Loans

Share bank account data with Easy Loans

3 easy steps

1

Select bank accounts to share

2

Verify chosen accounts

with OTP

3

Approve data sharing

Secured data sharing powered RBI licensed Account Aggregator

Learn more

Cancel

Easy Loans

←

Select bank accounts to share

Your mobile number

1

9876543210

Choose your salary account

Acme Bank

XXXXXXXX651

Acme Bank

XXXXXXXX410

Acme Insurance

XXXXXXXX234

OTP sent to 9876543210

To verify account XXXXXXXX651

987654

Easy Loans

←

Approve data sharing

Reason to share data

Duration of sharing data

See more

Reject

Easy Loans

Data sharing complete

Businesses already using our data stack

Quick and easy access to user financial data

Let users easily share their financial data for simplified verifications, on-boarding, and product experience.

Data sharing with pre-built screens

Give your customers a tried-and-tested UX to connect their financial data.

Custom configuration and smart routing

Responsive web/SDK journeys

Customisable UI with brand logo, colors, and fonts

An award-winning UI

Our loan monitoring demo, built with Snapmint, won at SamvAAd ’23 ↗.

Customise screens for your brand—

Brand name

Share bank account data with brand name

3 easy steps

1

Select bank accounts to share

2

Verify chosen accounts with OTP

3

Approve data sharing

Cancel

About OneMoney

Is it safe to share my data using OneMoney?

Yes, OneMoney is—

Direct data from authenticated sources

Prevent fraud with data straight from financial institutions that your customers use.

RBI approved system

Standard, machine-readable data

Convenient for you and your customers

Banks

NBFCs

Insurers

Investment funds

ETFs and SIPs

Mutual fund houses

...and more

✕

Snapmint's successful loan disbursals with Account Aggregator

75%

lower loan processing cost

3x

jump in financial data sharing by customers

27%

increase in revenue

Enhanced financial products and journeys

Diverse financial data

Get all the data a financial institute has to offer, with a single integration.

User profile information

Personal details such as mobile number, date of birth, PAN etc.

Summary data

Condensed view of financial data, like bank account balance.

Transactions data

Detailed financial data, like a monthly bank account statement.

Multiple use cases

Create products on top of financial data that your users have agreed to share.

Underwrite credit

Use financial data—income, spends, FOIR—to reduce risk when offering loans to your users.

Monitor loans

Analyse how your customers use their credit line to better predict their ability to repay debt.

Enable finance management

Help users manage their money with unified view of their income, spends, investments and more.

Verify users

Reduce fraud by verifying a user’s identity—their name, address or bank account details.

and more use cases

Better for you and your customers

Low effort integration, higher customer conversions

Integrate with an industry-best experience for developers, and an award-winning customer UI.

Hassle-free integration

We handle regulatory needs, so you can focus on building and experimenting.

Full-fledged sandbox

Test mock flows for user registration, data requests, and consent handling.

Customised testing

Test consent approvals, rejections or expiry with Setu’s high quality mock data .

Greater trust with customers

Build trust by guiding customers to share data securely.

Highlight recognised institutions

Point out the pros/cons of sharing data

Explain data purpose, storage duration, and access frequency

Consent, front and centre

Explain how you use and store users’ financial data.

Control for customers

Let customers review data access details, then decide to share data.

Better for you and your customers

Low effort integration, higher customer conversions

Integrate with an industry-best experience for developers, and an award-winning customer UI.

Hassle-free integration

We handle regulatory needs, so you can focus on building and experimenting.

Full-fledged sandbox

Test mock flows for user registration, data requests, and consent handling.

Customised testing

Test consent approvals, rejections or expiry with Setu’s high quality mock data .

Greater trust with customers

Build trust by guiding customers to share data securely.

Highlight recognised institutions

Point out the pros/cons of sharing data

Explain data purpose, storage duration, and access frequency

Consent, front and centre

Explain how you use and store users’ financial data.

Control for customers

Let customers review data access details, then decide to share data.

FAQs

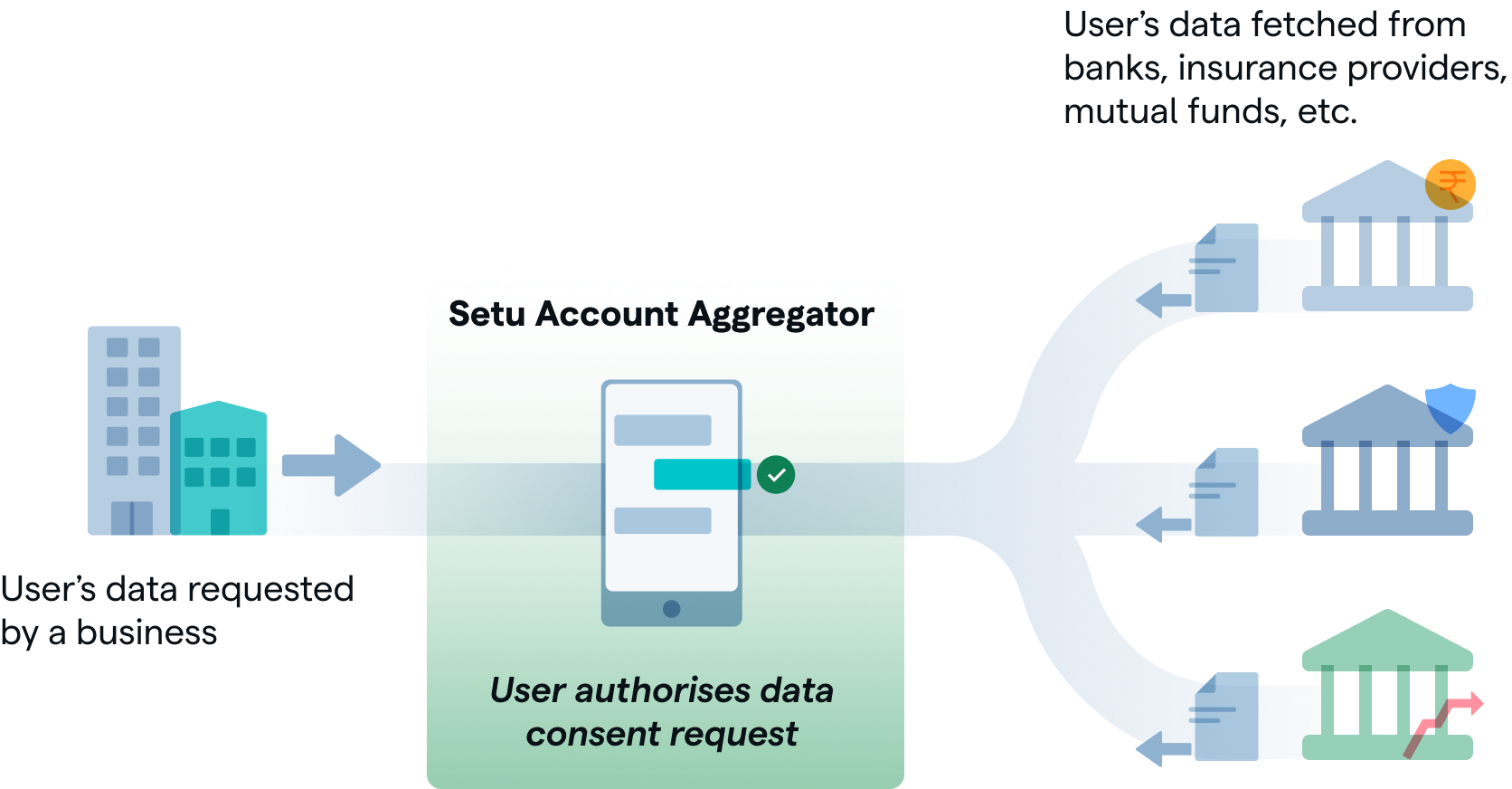

What are Account Aggregators?

Account Aggregators are RBI-regulated NBFC entities that allow a person to share and manage their financial data with companies under the new Data Empowerment And Protection Architecture framework. Learn more ↗

Financial data is only shared once the customer reviews a data request and approves it. Setu currently partners with licensed NBFC AAs, to help provide pre-built, customisable screens for users to register, approve/reject/manage data consent requests.

What are FIPs and FIUs?

An FIP, is a financial information provider—like a bank or an insurance company—that is able to share financial data around a user of their product or service.

An FIU, or financial information user, is an entity that is requesting for data from an FIP—for their customer—for purposes like verification or enabling financial products for users.

How does the Account Aggregator consent framework work?

When an app/website requests for financial data from a customer, the customer can review details of the data request on an Account Aggregator app/website that they have registered with. The data request includes details like—

Type of data

Reason for requesting data

Frequency of accessing data

Duration of storing the data

- ...and more

An FIU, or financial information user, is an entity that is requesting for data from an FIP—for their customer—for purposes like verification or enabling financial products for users.

The customer uses this information to approve or reject the request with a simple PIN based authentication.

A customer can also revoke consent for the data being shared. This gives complete control to users and also opportunities to financial apps and websites to build trust with their customers.

How can my organisation become an FIU on Account Aggregator?

You can become an FIU by completing the steps provided here ↗.