Setu BBPS

Power payments with BBPS

As a biller, become discoverable on all popular UPI apps and collect repeat payments with ease.

As a customer platform, embed and monetise bill payments with revenue for every successful payment.

Read more about BBPS ↓

Get paid easily anywhere in India, online or offline

←

Select your lender

?

🔎

Search by lender

All lenders

Bajaj Finance Ltd.

Cholamandalam Finance

Your business

HDB Financials

Home Credit

IIFL Fianance

Billers using BBPS to get paid—

Let users pay bills, and earn from businesses who get paid

Pay your bills

Airtel

Due in 5 days

LIC Premium

Bill generated in 25 days

Top categories

Electricity

Postpaid

DTH

Loans

Other payments

Platforms monetising bill payments—

Choose the right BBPS integration for your business

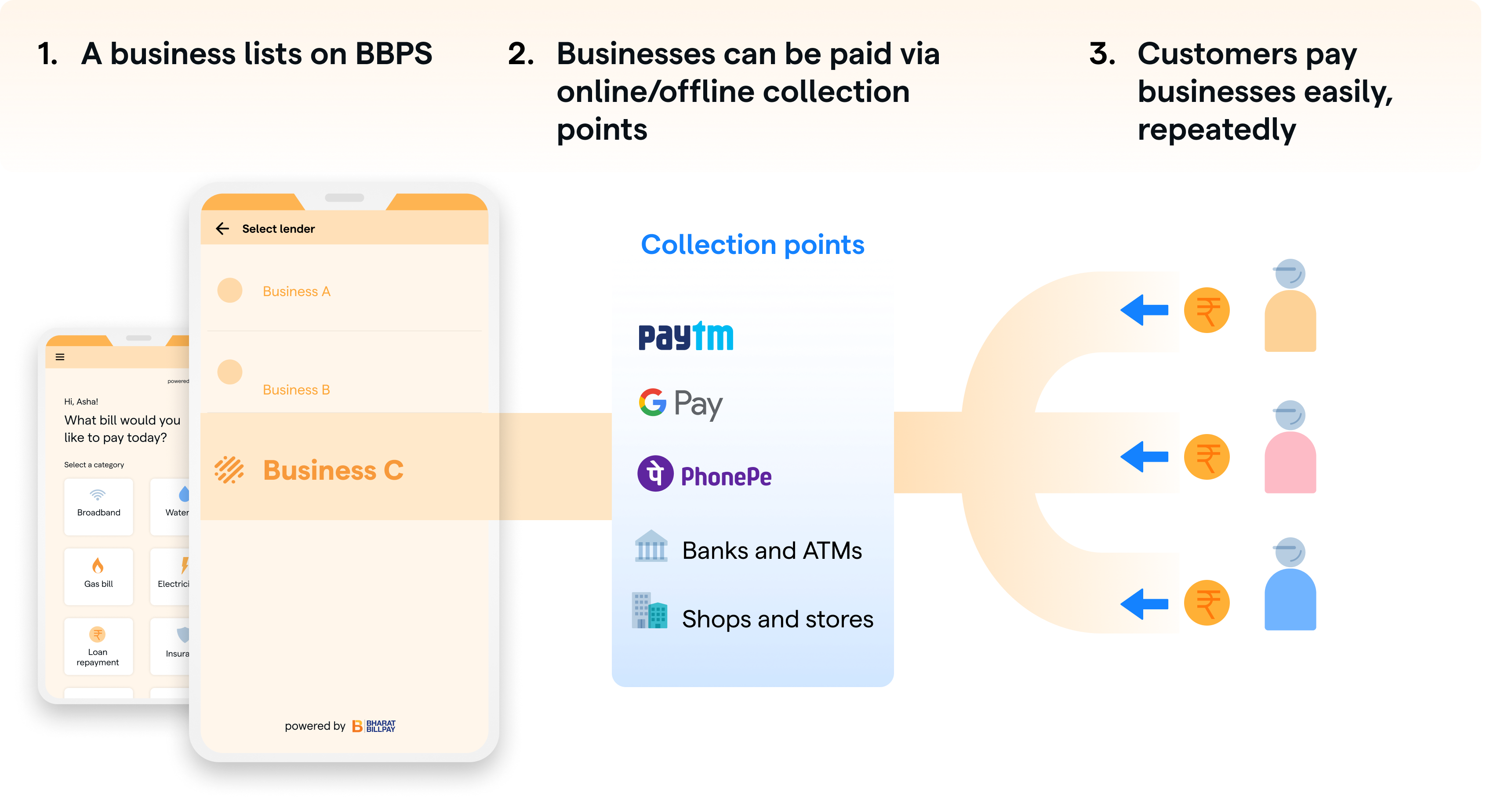

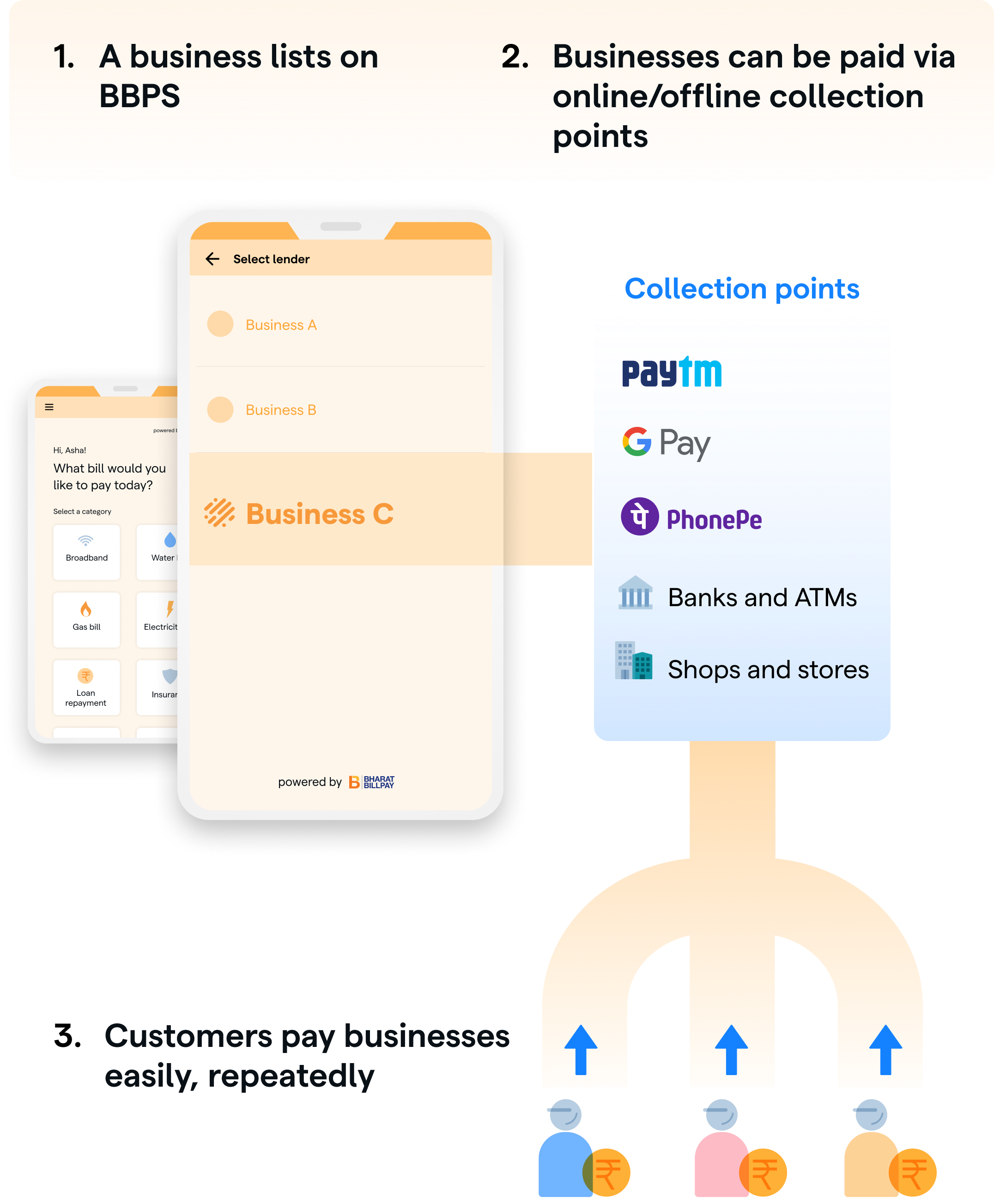

An interoperable network for payments

BBPS enables businesses to handle repeat payments from customers using platforms like payment apps or offline collection centers.

BBPS has billers—businesses seeking repeat payments—that are on-boarded by Biller Operating Units (BOUs)

BBPS BOU—integrate as a biller

Get listed as a biller on BBPS’s payment network to collect payments easily, repeatedly.

Collect payments ↗BBPS also has agents—customer payment apps / websites—on-boarded by Customer Operating Units (COUs)

BBPS COU—on-board as an agent

Sign up as a BBPS agent and let your users pay any BBPS biller to earn revenue.

Embed bill payments ↗Our BBPS bank partners

Setu works with trusted banks who are authorised to offer BOU and COU integrations.

Hassle free payments for customers and businesses

A single payment framework, to serve many stakeholders

Billers—businesses who need recurring payments

Any business offering monthly or annual services can collect payments through BBPS with a simple and cost-effective integration.

Agents—user-facing platforms for bill payments

Any platform can use BBPS to make money by offering bill payment services to their users—via apps, websites or offline centres.

Customers—wanting to pay businesses easily

Customers can choose any popular BBPS-enabled app, website or offline point to pay their bills easily and regularly.

The BBPS network has—

400+ online agent institutions, which are payment apps and websites for customers to pay billers

BBPS also has 3.5 million+ offline agents like bank branches, kirana shops and more, supporting payment in 10k+ pin codes in India.

Below is a demo for how a customer pays a biller on BBPS, using a BBPS-enabled agent app—a customer paying back their EMI to a lender.

STEP 1

A customer searches for their lender.

☰

Home

Hi Asha!

What bill would you like to pay today?

Select category

Loans

Recharge

Insurance

Rent

Loans

Subscriptions

←

Loans

Select your lender

New Leaf Credit

Red Valley Capital

GKNB Credit

OnTap Loans

Young India Finance

Ample Capital

STEP 2

They enter their loan ID.

←

New Leaf Credit

Enter the loan number

PL 83450 453

STEP 3

They see their bill, pay amount and get a receipt.

←

Repayment due

Loan #PL 83450 453

Balance

₹50,000.00

Loan repaid!

Download receipt

https://dmr-ss.com/receipts/jh91-2239-83

Access the best integration experience

Whether you opt for our BOU integration for billers, or COU on-boarding for agent institutions, we’ve got you covered.

Painless on-boarding

Get guidance on regulatory compliance and go live in days.

No-fuss integrations

Opt for no-code biller integration or use theme-able, pre-built screens for embedding bill payments as an agent.

Grow your business

Collect payments online or offline, with one integration. Or boost user retention and revenue by embedding bill payments.

BBPS BOU—integrate as a biller

Get listed as a biller on BBPS’s payment network to collect payments easily, repeatedly.

Collect payments ↗BBPS COU—on-board as an agent

Sign up as a BBPS agent and let your users pay any BBPS biller to earn revenue.

Embed bill payments ↗FAQs

What is BBPS?

Bharat Bill Payment System is a payment ecosystem on which different categories of billers can register on, with bill payments enabled for utility bills, loan EMIs, school fees, subscriptions and more.

BBPS is run by NPCI that enables bill payments via digital (bank channels) as well as through a network of agents & bank branches

What is NPCI?

National Payments Corporation of India maintains the BBPS payments system. It undertakes clearing and settlement activities for transactions routed through BBPS.

NPCI is also responsible for setting business standards, rules and procedures for technical and business requirements for all market participants. It is the regulatory body for BOUs, who are entities allowed to on-board billers onto BBPS.

What is BOU and COU?

BOUs or Biller Operating Units and COUs or Customer Operating Units are licensed entities (usually banks) ) who can offer BBPS services to other businesses. Setu works with BOUs and COUs to offer corresponding integrations.

BOUs serve billers, i.e entities that generates bills for goods or services and want to collect payments. Setu’s BOU integration helps billers list on BBPS to enable collections via BBPS apps or offline points.

COUs serve customer-facing platforms, i.e entities that offer various products to any end-user. Setu’s COU integration helps such platforms become a collection agent for BBPS and add a feature to let their users pay any BBPS biller.

What role does Setu play?

Setu acts as a bridge between BOU/COU banks and other businesses (billers or customer-facing platforms), offering simplified integration and compliance. We also offer additional services like data reports, notifications and settlements for any bill payments.