Setu Collect addresses key challenges in the Indian lending market, particularly rising NPAs and inefficiencies in traditional loan collections. By leveraging AA-driven consent management and, Setu Collect enhances the collections process while providing an early warning system (EWS) for potential defaulters.

IN FOCUS

India’s first gateway for Account Aggregator—

Setu Account Aggregator gateway

Access financial data with user consent

Risk Management focus

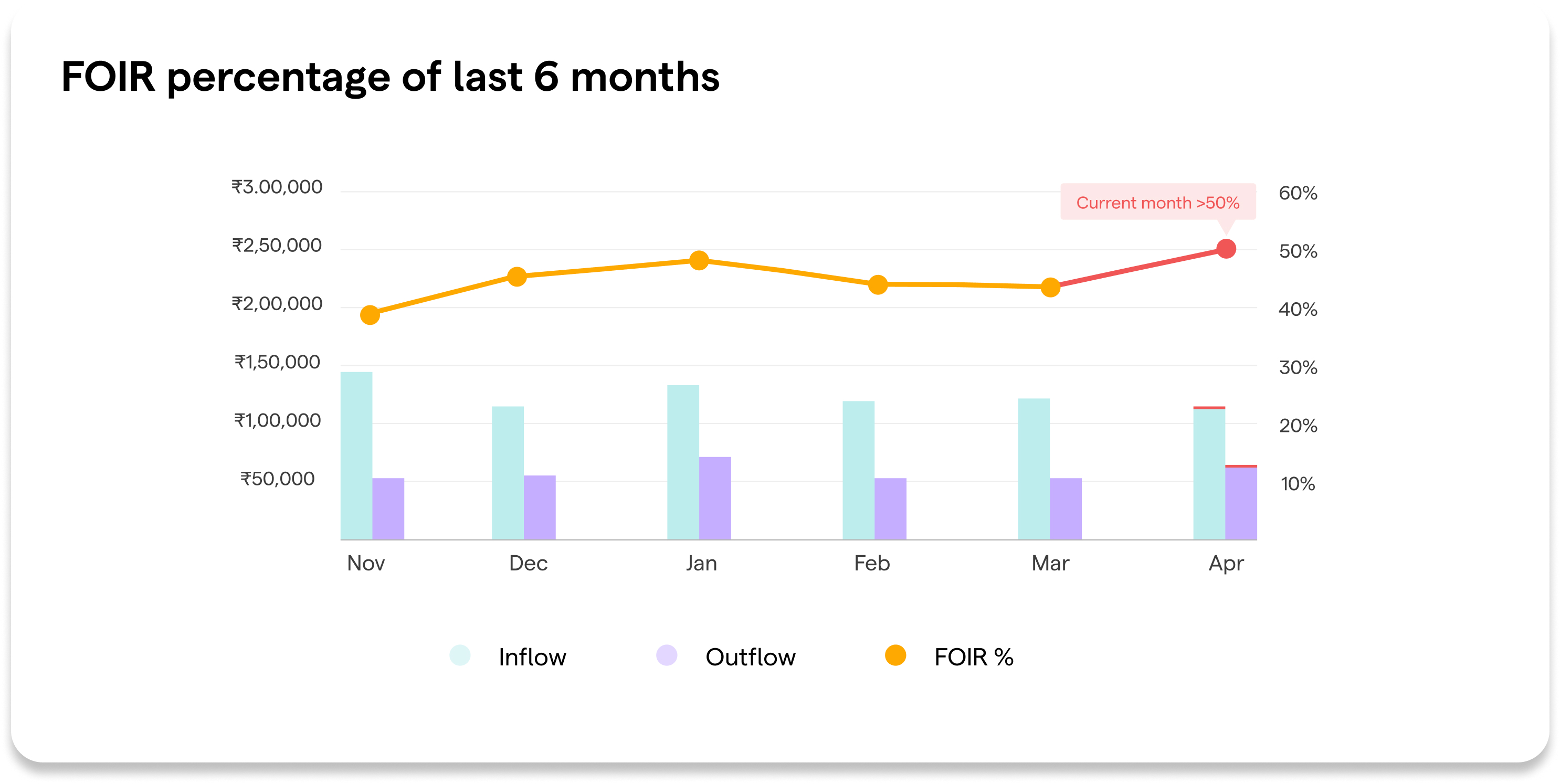

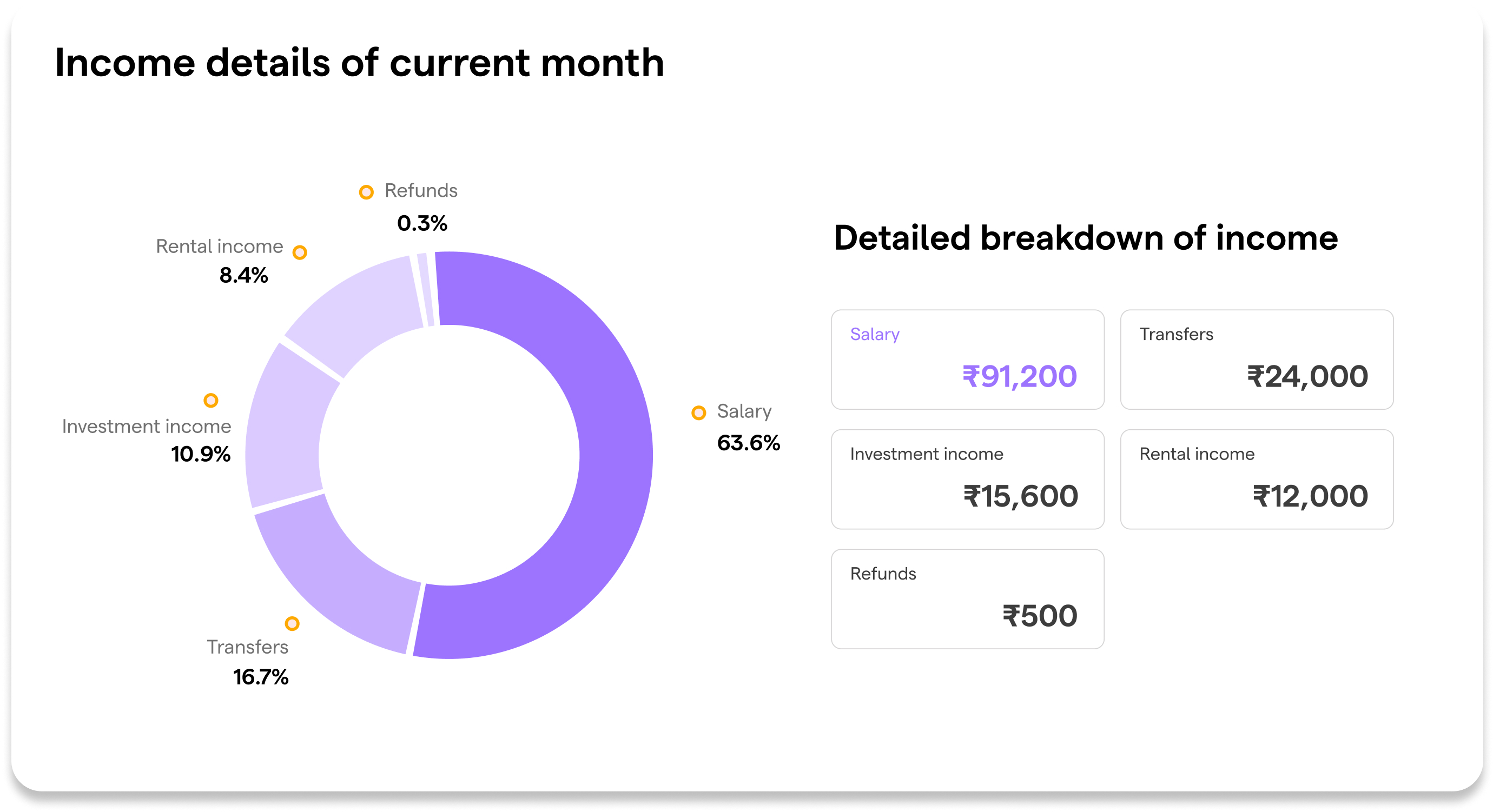

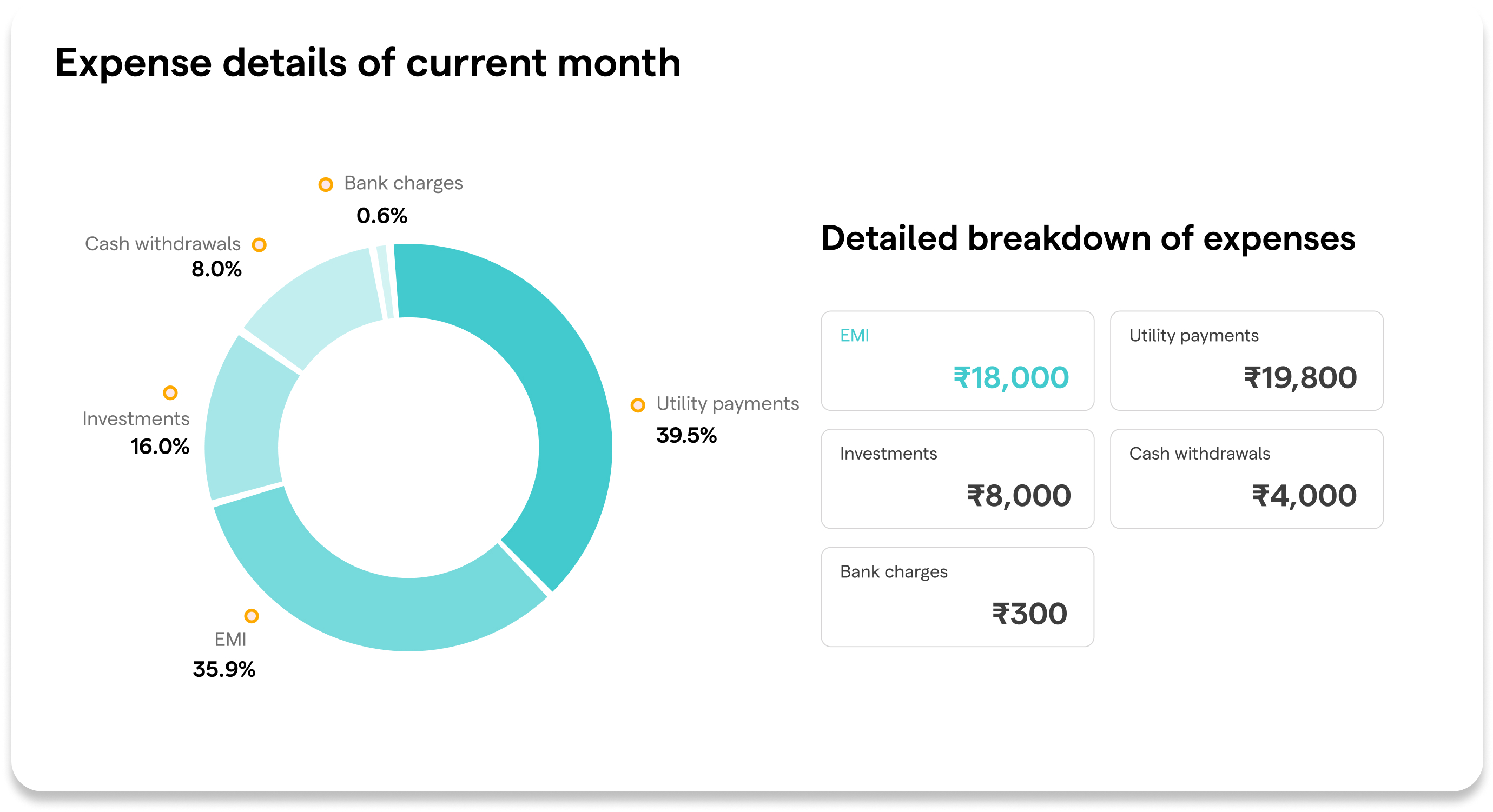

Fraud detection: Setu Collect identifies unusual spending or income patterns in borrower accounts that could signal risks of defaults or fraud.

Early Warning System: By analysing FOIR (Fixed Obligations to Income Ratio) and flagging changes in the borrower’s financial data, the system offers real-time risk monitoring, reducing the likelihood of defaults and optimising collections team spends to focus on the riskiest customer segments.

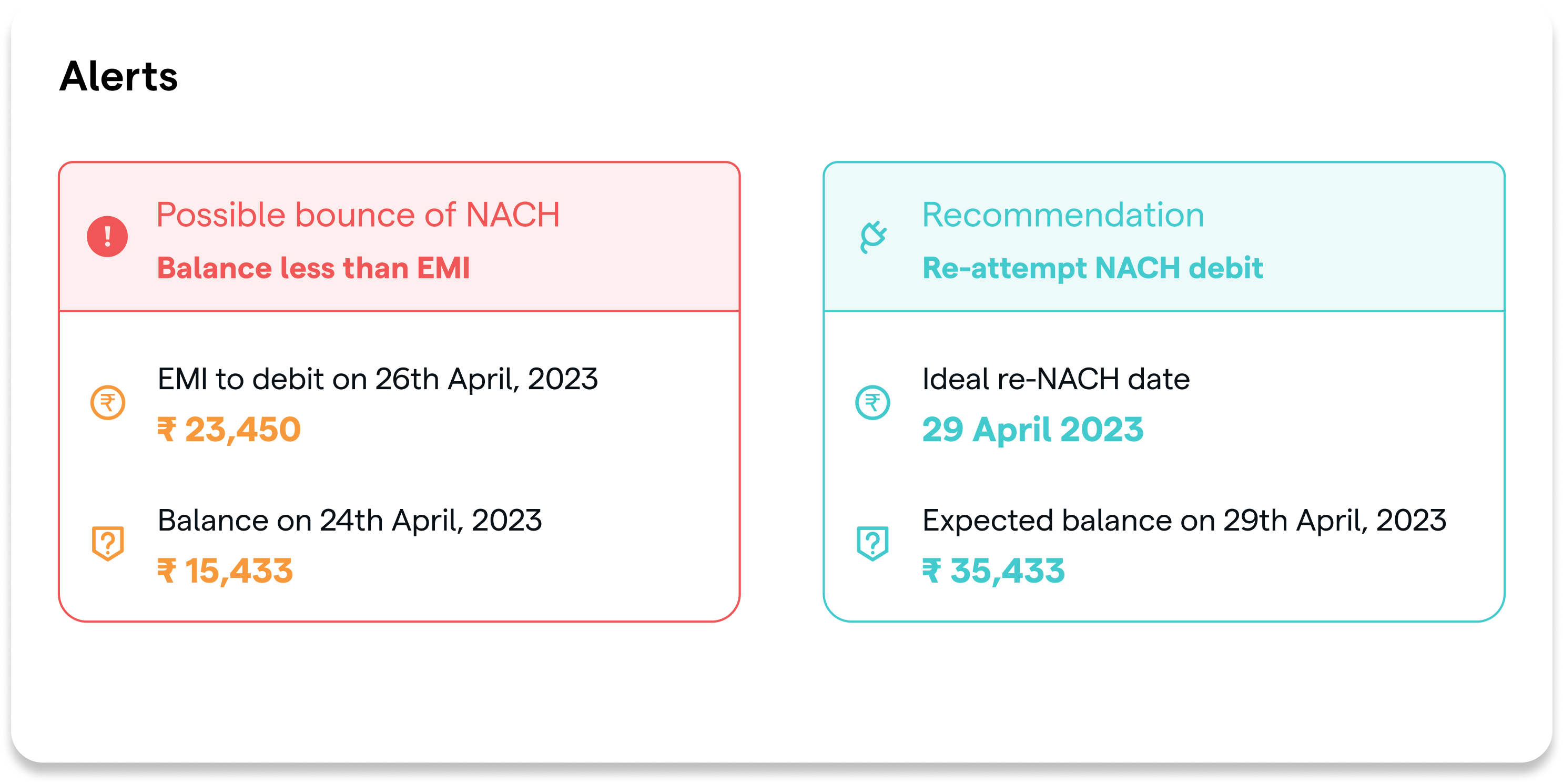

Collections optimisation: Automated fallback options and balance checks via AA to reduce collection failures, a major contributor to DPDs in the lending ecosystem.

Fallback collections options: Fallbacks to UPI autopay, UPI deeplinks or Bharat Connect loan repayment options based on customer balance checks.

Innovation

Setu Collect goes beyond simple payment mandates to offer an end-to-end tech-driven collections module. By integrating AA-driven insights for balance checks, mandate status, and fallback payment options, we automate collections and enable real-time decision-making. The dual consent flow further enhances transparency, improving both lender and borrower experiences.

Implementation

A typical collection workflow begins with a customer onboarding journey—Setu monitors customer balances before EMI due dates, sending alerts if balances are low.

Outcomes and metrics

NPA reduction

By sending early warnings based on AA data and automating fallback options, the solution aims to reduce NPAs in the lender’s portfolio.

Operational efficiency

Automation of mandate setup, real-time balance checks, and fallback payments significantly reduces the high cost of collections (15-20%).

Customer satisfaction

Flexible payment options and proactive notifications improve the repayment experience, reducing borrower stress and default rates.

Explore other Setu products

Partner with Setu on other products that can serve use cases for lenders